Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Last updated 31 maio 2024

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

How Much is the IRS Tax Underpayment Penalty? - Landmark Tax Group

Penalty for Underpayment of Estimated Tax & How To Avoid It - Picnic Tax

Avoiding Underpayment of Tax Penalty - TaxSlayer®

Failure to Pay Penalty: What to Know - Rush Tax Resolution

What Is a Tax Underpayment Penalty?

Avoiding Underpayment Penalty: The Consequences of Late Payment - FasterCapital

IRS Underpayment Penalty and Making Estimated Tax Payments in 2019

:max_bytes(150000):strip_icc()/irs-pub-433.asp-Final-060f721b11b441b0a4b85b4ec6c6186a.jpg)

IRS Notice 433: Interest and Penalty Information

What Are the Penalties for Underpaying Estimated Taxes?

Penalty for Underpayment of Estimated Tax

How To Make Quarterly Estimated Tax Payments For Ministers - The Pastor's Wallet

Recomendado para você

-

PENALTY SHOOTERS 2 - Play Online for Free!31 maio 2024

PENALTY SHOOTERS 2 - Play Online for Free!31 maio 2024 -

What is the longest penalty shootout in football history?31 maio 2024

What is the longest penalty shootout in football history?31 maio 2024 -

Footscan Technology Reveals Biomechanics of the Penalty Kick31 maio 2024

Footscan Technology Reveals Biomechanics of the Penalty Kick31 maio 2024 -

Penalty Kick Wiz 🕹️ Play on CrazyGames31 maio 2024

-

Penalty - Apps on Google Play31 maio 2024

-

Grey Wiggle no more: new penalty rules set to be introduced in July31 maio 2024

Grey Wiggle no more: new penalty rules set to be introduced in July31 maio 2024 -

Pollard's late penalty sends South Africa into World Cup final31 maio 2024

Pollard's late penalty sends South Africa into World Cup final31 maio 2024 -

What Percent of Penalty Kicks Affect Soccer Games and Leagues31 maio 2024

What Percent of Penalty Kicks Affect Soccer Games and Leagues31 maio 2024 -

Penalty Challenge 🕹️ Play Now on GamePix31 maio 2024

Penalty Challenge 🕹️ Play Now on GamePix31 maio 2024 -

What is a penalty shootout and how does it work in the World Cup31 maio 2024

What is a penalty shootout and how does it work in the World Cup31 maio 2024

você pode gostar

-

Among Us - Play Free Online Games - Scorenga Games31 maio 2024

Among Us - Play Free Online Games - Scorenga Games31 maio 2024 -

Assetto Corsa Competizione - Intercontinental GT Pack (DLC) Steam Key GLOBAL31 maio 2024

Assetto Corsa Competizione - Intercontinental GT Pack (DLC) Steam Key GLOBAL31 maio 2024 -

starpets again cuz im broke 😻 #wfl? #roblox #adoptme #fyp31 maio 2024

-

Waving Stickman With Red Tie PNG Images & PSDs for Download31 maio 2024

Waving Stickman With Red Tie PNG Images & PSDs for Download31 maio 2024 -

Jogos de Guerra do PS2 que Poucos Conhecem - Parte 431 maio 2024

Jogos de Guerra do PS2 que Poucos Conhecem - Parte 431 maio 2024 -

DrMemeMedic on X: I drew SCP-682 #SCP #SCPFoundation #fanart31 maio 2024

-

A ring girl signals the beginning of round 12 during the WBO31 maio 2024

A ring girl signals the beginning of round 12 during the WBO31 maio 2024 -

Magical Sempai 6 ebook by Azu - Rakuten Kobo31 maio 2024

Magical Sempai 6 ebook by Azu - Rakuten Kobo31 maio 2024 -

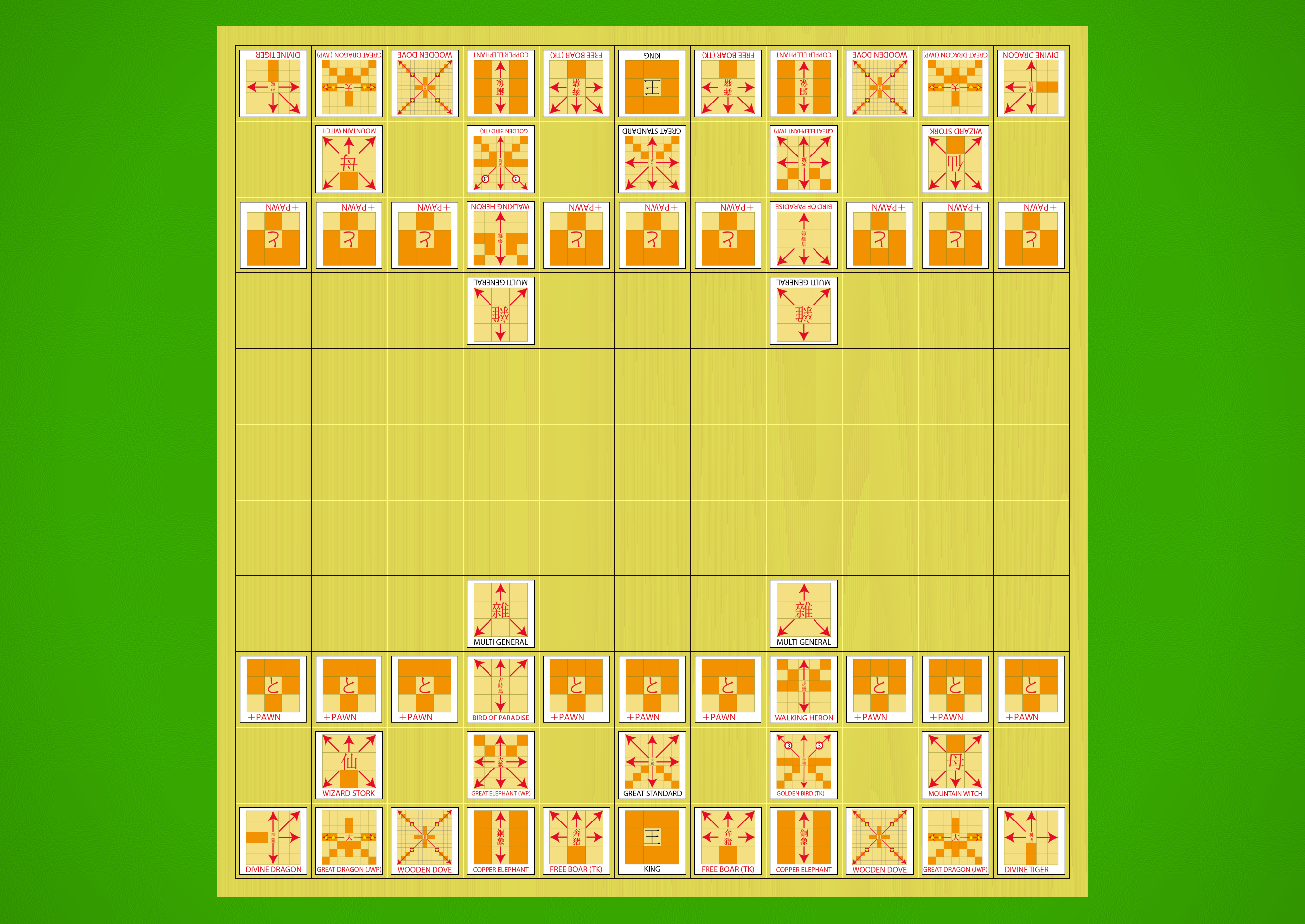

Shogi Dr Eric Silverman31 maio 2024

Shogi Dr Eric Silverman31 maio 2024 -

Confira animes de janeiro na Funimation - Olhar Digital31 maio 2024

Confira animes de janeiro na Funimation - Olhar Digital31 maio 2024